Modelling constraints in the NEM: insights from a large-scale augmentation

When assessing major transmission upgrades in the National Electricity Market (NEM), the Regulatory Investment Test for Transmission (RIT-T) ensures benefits justify the costs. The recently approved HumeLink project is expected to reduce costs by lessening the need for new generation capacity and cutting thermal generation. However, its broader impact on network performance hasn’t yet been fully examined.

HumeLink is one of latest major augmentations to have received Contingent Project Application (CPA) approvals from the AER. Similar to other major transmission augmentations, HumeLink’s benefits are forecast to be derived from Capex and fuel cost savings by avoiding additional capacity buildout and offsetting thermal generation respectively.

HumeLink has rarely been looked at from other angles

Let’s take a deep dive into the augmentation from a network performance point of view.

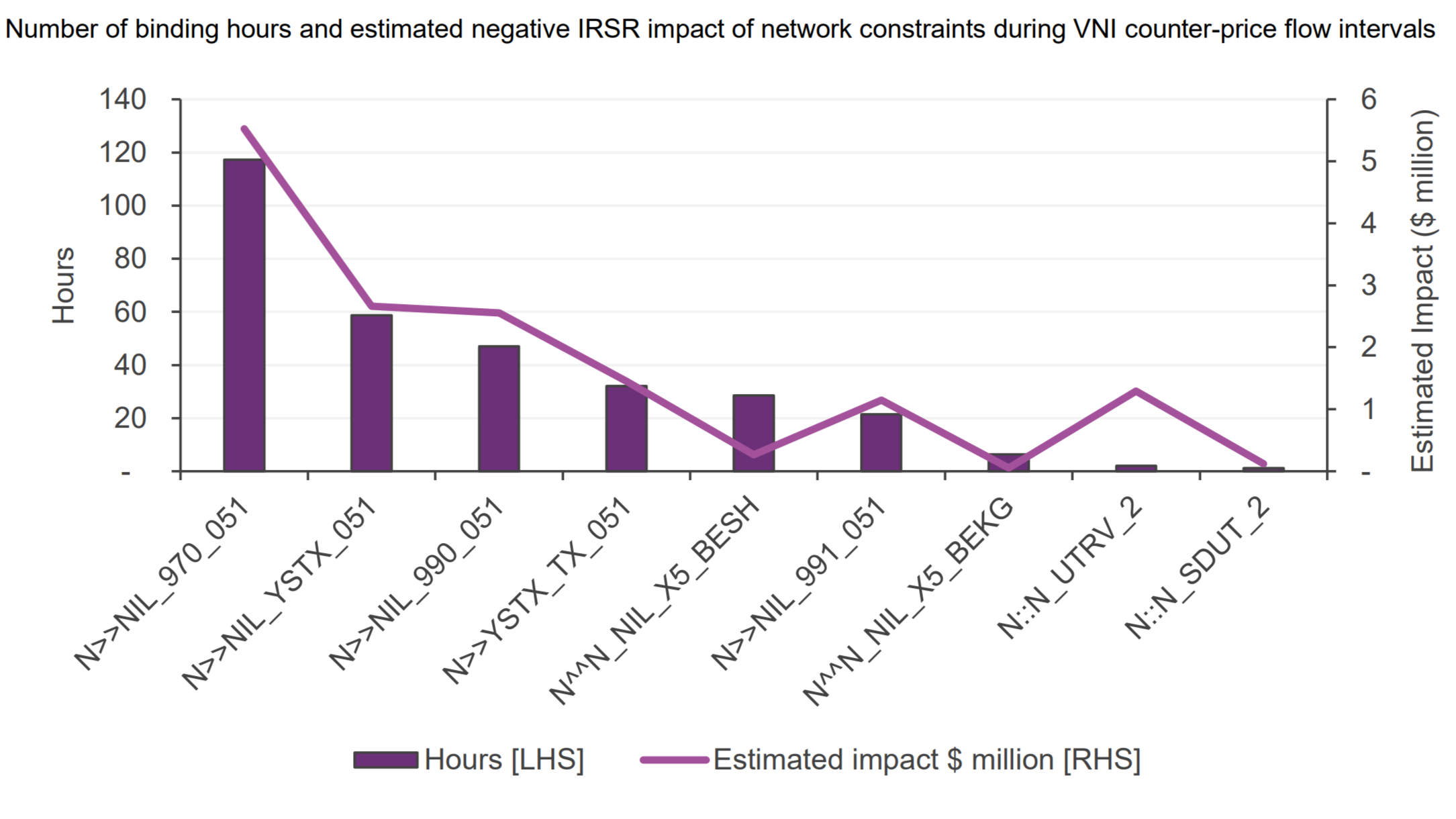

A recent report by AEMO, Quarterly Energy Dynamics (Q4 2023), highlighted that counter-price flow on VNI was primarily driven by the binding of the Yass 132kV/330kV transformers. One of these constraints representing this condition was “N>>NIL_YSTX_051”, being “Out = NIL, avoid O/L of either Yass 132/330kV on trip of Wagga to Lower Tumut (051) line, Feedback”. This constraint resulted in around $2.5m impact to the market across the quarter.

Image: Network issues causing counter-price flow, source: Quarterly Energy Dynamics Q4 2023 January 2024

So, what impact could HumeLink have on this constraint, and as a result, the frequency of counter-price flows across VNI?

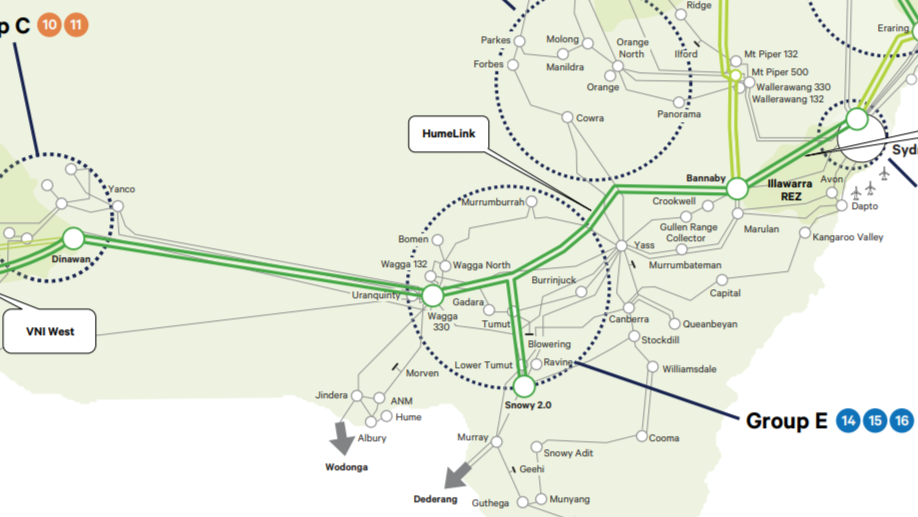

From a first look at the map, one wouldn’t think HumeLink would materially impact the constraint as HumeLink is bypassing the Yass 132/330kV transformer.

Image: Transgrid’s network development plan, source: Transgrid Transmission Annual Planning Report 2023

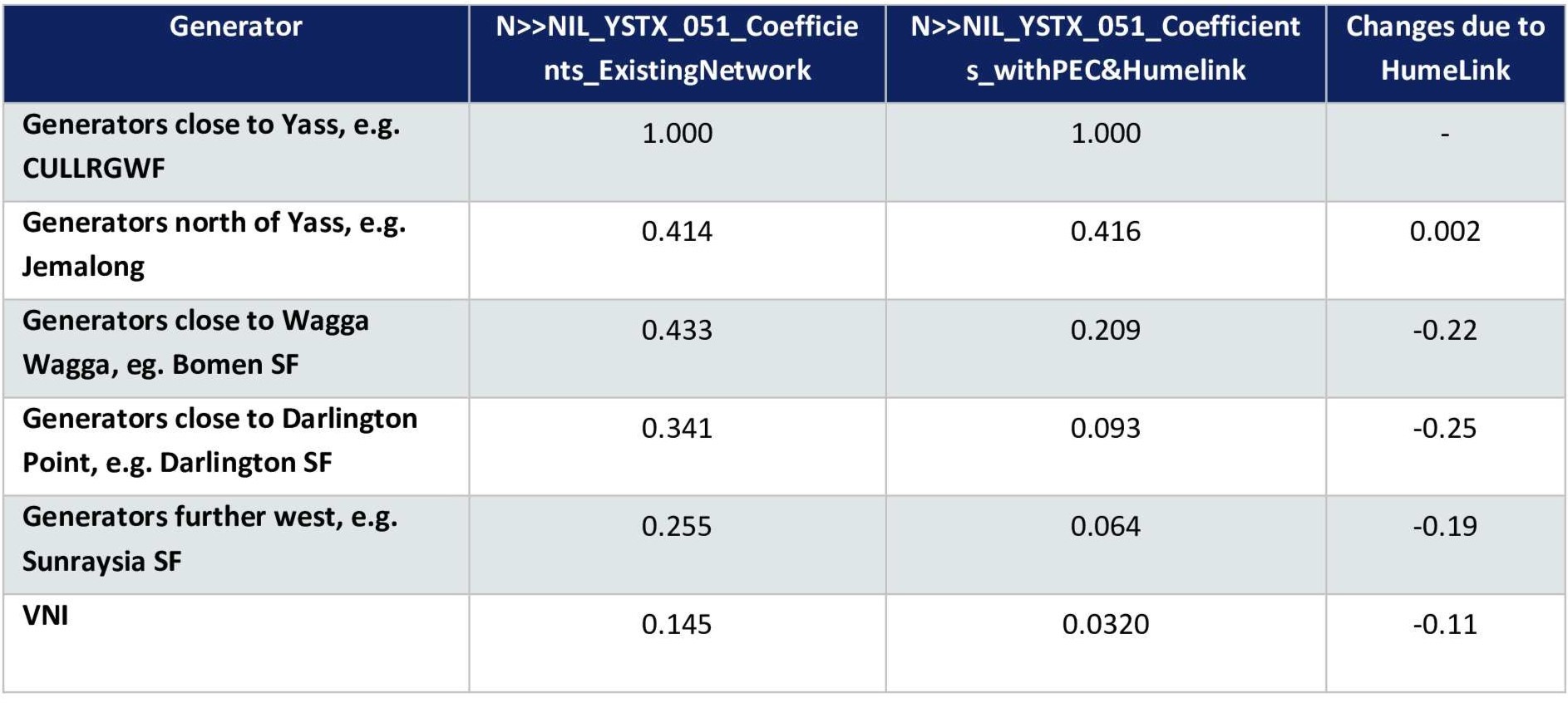

Let’s take a closer look at this constraint. In Table 1 below, we’ve created the constraint for the Yass transformer under different conditions: for the existing network and a network with HumeLink (and PEC). We are now able to compare the coefficients of some sample locations/generators including VNI.

Table 1: Yass transformer constraints under different conditions (note: the coefficients might be different as approximation is used in HumeLink network)

The coefficient of generators near Yass are not expected to change, while there is a slight increase in generators north of Yass towards Parkes. However, major changes are seen on generators south and west of Yass, including VNI. Coefficients for generators in southwest NSW are expected reduce significantly with HumeLink in place, which will assist reducing loading on these transformers. But more interestingly, the coefficient for VNI is expected to reduce by one third and also moves to the RHS, essentially eliminating counter-price flow caused by this constraint.

HumeLink promises to reduce costs and alleviate congestion. Early analysis suggests it will also ease constraints related to the Yass 132kV/330kV transformers, potentially eliminating counter-price flows at VNI. As the project progresses, monitoring its impact on network performance will be key to fully understanding its benefits.

Gain greater clarity through every project phase

At EPEC, our core market modelling forecast includes critical assessments on constraints including generation curtailment (network driven or economic spills) as well as MLF and DLF forecast – providing a long-term commercial outlook for renewable energy projects.

For more information, contact Nadali Mahmoudi, Electricity Network Advisor, EPEC Group at nadali.mahmoudi@epecgroup.com.au.